Posts

The major bonuses offered by gambling enterprises is free spins, 100 percent free bucks, deposit extra, etcetera. Web based casinos also have more game than simply property-founded gambling enterprises. Sometimes, casinos on the internet could have thousands of titles more a secure-centered casino because of the fact that it aren’t restricted to real room. You might be using real buyers thanks to load-founded technical which allows you to feel as you have been inside the a bona-fide house-based local casino but without leaving your residence.

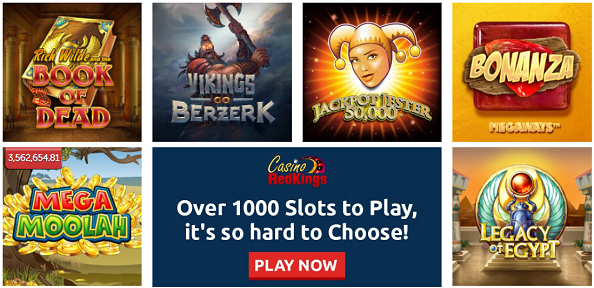

It’s got a modern framework, more than 850 games to choose from, and many high bonuses for both the newest and you can present professionals. One sets it one of many greatest lower deposit on line casinos inside the 2024. Click the banner lower than to visit which online casino and speak about all of the fun video game it should provide. Public gambling enterprises provide yet game your’d see from the a classic internet casino, nevertheless they don’t offer people genuine gaming opportunities. Because currently really stands, DraftKings is the greatest (and simply) $5 minimal deposit local casino in america.

Casino bethard review: 🎁 The way to get incentives during the a great $3 lowest put gambling establishment?

Way too many of them, in reality, that you may possibly think they’s impractical to find one with a decreased deposit demands. You could potentially play ports, black-jack, or other $3 deposit gambling games as the minimum initial financing. These are also known as ‘minimum put gambling enterprises,’ otherwise casinos with a minimal entry level. It’s as simple as enrolling and receiving already been as opposed to spending much money. Whether we want to enjoy from the an international web site with high games diversity otherwise from the a local user offering private bonuses, tips, and you can strategies – why don’t we learn more.

£step three Deposit Bingo Internet sites

- When shopping for a professional, low-put mobile local casino, Pribet is yet another advanced option.

- Regarding for example circumstances, pay-by-cellular telephone costs are some of the handiest of them.

- Slot video game are among the gaming teams favorite wade-to video game to try out.

Due to this CasinosHunter advises a summary of more smoother financial strategies for short places inside fiat currencies. I’ve a much bigger overview of gambling enterprise payment steps nevertheless dining table lower than gets four finest procedures plus the fees used because of the her or him for every transaction. Develop, this article will tell you a little more about $3 put local casino information.

I would also like to pay for numerous weaknesses, that is critical for some of you since the participants.. In control betting are a casino bethard review significant method to engaging which have gambling issues, prioritising the fresh better-getting and you may security of people. They encompasses numerous core values, and self-sense, mode limits, understanding the possibility, and you may recognising when you should look for assist. It is more about and then make advised conclusion and you may maintaining control over one’s gambling. With the addition of their elizabeth-mail your commit to discover everyday local casino promotions, and this will end up being the best purpose it might be put to have. BetWhale is actually a licensed, real-currency local casino which have a strong work on its comprehensive sportsbook.

An educated payment choice is one that does not require the newest put away from a premier percentage. For this reason, to deposit 3 pounds, it is practical to make use of credit cards otherwise elizabeth-purses. Such as this, you can put as little as £step 3 rather than overpaying high income. As opposed to to make a large immediately after-away from put, short dumps render responsible gambling. People can be put what they are able to afford, while not having to build a hefty deposit away from $20.00 once of.

- In addition to, just be 21+ years old in order to be eligible for the new 888 no deposit incentive and be based in New jersey.

- Lowest deposit casinos is on the web gambling programs that enable people to begin to experience by simply making a little 1st put.

- This type of perks, which are often a little lucrative, come with a few added bonus terms that you must comply with ahead of they can be became a real income.

- Most incentive software will be readily available for many who deposit the minimum matter.

- Talking about Hd streams from actual croupiers and investors, enabling a much more authentic internet casino to experience experience.

Totally free spins wade hand in hand that have step 3 min deposit local casino selling, identical to spaghetti goes better offered particular sensuous ketchup. Fifty or even more spins can be lead to far more as opposed to those first three bucks when you’re deteriorating those individuals winnings is generally subjected to specific laws otherwise conditions. Apart from that, what is actually 100 percent free stays totally free, whether one’s funds are three cash otherwise 300 cash. Something that home-founded casinos won’t be capable overcome is merely just how a on-line casino incentives is. It is possible so you can allege totally free spins, 100 percent free bucks, or other totally free rewards because of the simple fact that you have got an internet casino account upon which all of these bonuses is also end up being connected. You may still get free money in home-founded gambling enterprises, nevertheless the cash alternatives are much all the way down.

Bonuses and Offers to possess $ten Dumps

Perhaps you have realized, there are many different things to take a look at when searching for the newest on the web gambling enterprises. No in the all of that problem if you only prefer a deck in the listings right here to your all of our web site. Our specialist group has recently achieved the necessary inspections in order to always can enjoy in complete safety and you can defense appreciate an informed online gambling sense you can.

Gambino Ports Local casino

Regarding added bonus also offers and you will casino perks, gambling enterprises always put the absolute minimum deposit requirement of ten otherwise 20 GBP. But not, for the lowest put online casino sites that individuals utilized in all of our listing, you will end up qualified to receive gambling establishment bucks bonuses otherwise added bonus spins despite a small put. Just before to experience, see the minimum put criteria on the incentive provide for individuals who should redeem they. This is why i have chose to list all lowest put gambling enterprise websites and the best minimum deposit bonuses for people. Come across the set of all greatest lowest deposit gambling establishment without minimal deposit gambling establishment internet sites that let you start gaming with just several pounds.

Dumps from NZ$ten often qualify for generous invited incentives and you may promotions, significantly boosting a person’s carrying out dollars. Casinos on the internet both prize people that are ready to make an excellent highest put that have finest customer care, reduced withdrawal minutes, and other incentives. When making in initial deposit of at least NZ$5, professionals are typically entitled to actually larger greeting bonuses and you may incentives. Such NZ$5 put gambling enterprises have a tendency to accept a wider assortment from put and you will detachment alternatives than simply the opposition. PlayZilla is actually renowned from the their nice invited offer, which consists of 500 100 percent free revolves and an excellent one hundred% match up to help you NZ$1500.

The internet gambling enterprise will provide you with 100 percent free cash because the an excellent no-put gambling establishment incentive to have registering on the website. A great $5 minimal deposit gambling enterprise is actually an on-line casino where you could claim incentives and begin playing your favorite game with in initial deposit out of merely $5. A good example of a leading $5 minimal put gambling enterprise are DraftKings, for which you’ll discover over step 1,000 enjoyable real cash online casino games and you will ample incentives you could claim just for $5.

The bulk of British web based casinos encourage £ten while the minimum deposit in order to allege a bonus. So in this case, we are taking a look at the best gambling establishment incentives an excellent £ten deposit can get you. The best step three dollar put gambling enterprises can offer a good affiliate sense, low minimal dumps and you can a good quantity of online game.